Interest Rate

What are the Benefits of Gold Loan?

Availing of loan against gold is a good idea to help you fill the gap when you are in need of cash. Loans against gold are attractive avenues for people as they have the comfort of paying the amount in time or before time.

The best way to choose the best loan for you is by comparing the gold loan interest rates. Muthoot’s interest rates are competitive and their tailor made features help you get the most out of your gold.

Here are the benefits of a Gold Loan:

No income needed:

Banks take into consideration your credit history and your pay back capacity while considering you for a loan. Banks prefer those individuals who have a good pay structure as it is easier for them to pay the loan back.

However, minimal documentation is required to get the gold loan sanctioned from Muthoot Finance. Also, Muthoot will provide you with a loan of certain pre-decided percentage of the gold pledged. The loan is sanctioned on the basis of the quality of the gold pledged. Thus, even an unemployed person can avail of this loan.

Weak Credit Record

Even if you havea weak credit history, the loan lending institutions arenot affected by it. Since, it is a secured loan and you are pledging gold as collateral, the lending institution does not need to assess your credit history. Even though you have a weak credit history, you can avail of a loan against gold when in need of money.

Low interest rate

Another benefit of a loan against gold is the low interest rate. It is lower than the interest charged by banks for personal or home loans. The interest rates vary between 12%-16% annually. This is particularly beneficial for those who are looking to borrow money at an affordable rate.

One-time payment

You have the choice to make a onetime payment. This means that you can choose to pay only the interest during the loan period and the rest of the amount in a single payment at end of the loan duration.

Convenient

Our gold loans are convenient and quick as they take just a few minutes (15-20) to be disbursed. The financial institutions sanction not more than 75% of the market price of the gold pledged.

Easy repayment procedure

Unlike personal or consumer loans, you need to repay the gold loan at the end of the loan tenure. You do not have to go through hassle of paying EMIs every month. However, specific interest amount has to be serviced periodically as per the terms of sanction. Repayments can be done by cheque, DD or cash.

Conclusion

Our gold loans are good bet for you, if you are in need of lump money and you don’t have the required documentation to avail of conventional loans. So, the next time you need to give your finances a push, think gold.

Best Deal Challenge

For the Best in the Business…

Muthoot Finance brings to you the best deal challenge with overdraft facility for business men, a trend setting offer for those Indians who are out to chase their dreams and ideas. Muthoot finance has the largest gold loan portfolio in line with their long standing tradition of setting up new benchmarks in customer centricity and customized offering for specific customer segment is charting out a new mile stone for the business class customer. Muthoot has gone to great lengths to understand and structure the peculiarities involved with short and medium term financial need of the business class.

We have a team of 25000 present across 21 states and 4 union territories through 4400 state of the art hi-tech branches with unrelenting customer focus that has ensured the end customer gets the best deal across the crowd of plethora of technically complex, shrewdly packaged offerings.

The “BEST” of the Best deal challenge:

- 17% monthly interest rate.

This rate turns out to be roughly 14% per annum basis. This is integrated with the convenience of minimal documentation and speedy turnaround time for on dot disbursement characterized by Muthoot. These competitive interest rates are at par or even better then banks.

- No change in interest rate for one year.

This helps businessman plan their finances with considerable degree of stability and without the worry of change in monthly instalments and overall impact on the core business. Assured monthly outlay of instalment reduces the volatility ensuring greater efficiencies.

- 2% rebate for regular interest payers.

This is a great reward for the legitimate, genuine and financially prudent customer. The resultant rate is hard to find even with the best of the banks in the current market.

- Maximum loan amount

Muthoot Finance has a proven track record of offering the best value for your precious gold holdings in terms of loan to value in the utmost convenient way through in-house values.

- Free Insurance of your gold holdings

At Muthoot Finance we value your emotional connect with your jewellery. With free insurance total protection is guaranteed, that too free of cost.

- Allows monthly instalments up to 36 months

Adding to the stability and continuance now the power to plan your instalments are in your hands. Let’s make the most of it.

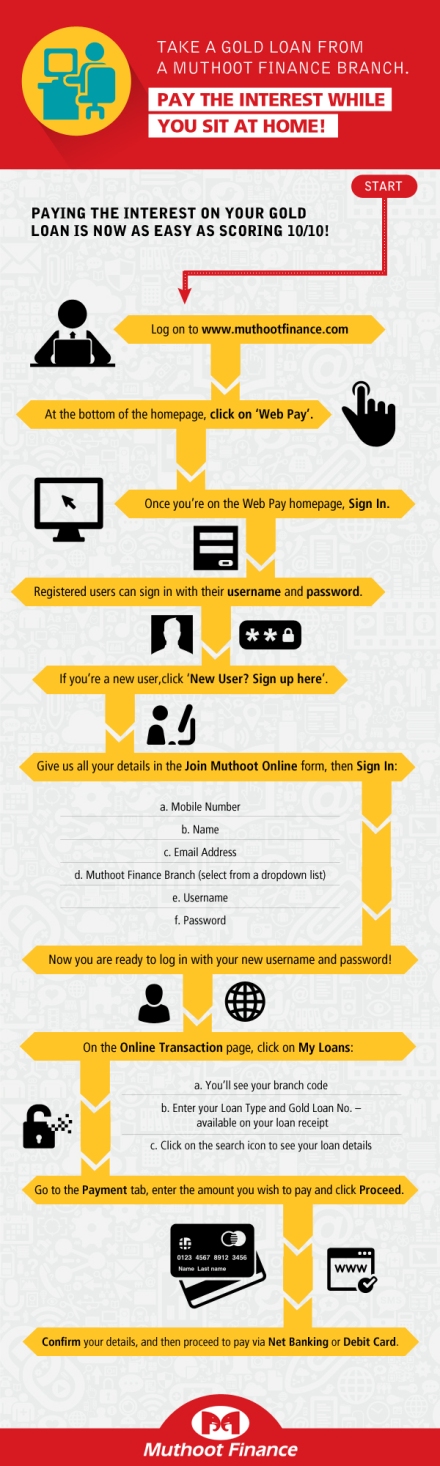

- Pay your instalments online

Gold loans were never so proactively convenient. You can pay your instalments anytime, anywhere.

- Dedicated relationship executive

Ensuring best in-class service and prompt turnaround time at every stage isthe motto of Muthoot. Our dedicated teams of service executives are here to help you and take you through the process.

Call us

We at Muthoot finance are with you all the way in your quest to excellence, don’t wait to experience the delight of best deals with us, take up the challenge today call us on 1800 120 2838 or SMS GOLD to 56161

The Muthoot Group – A Mighty Conglomerate

Muthoot Finance Easy Loan.

Convenient Consumer Loan: Owning consumer durables became a whole lot easier!

Consumer durables is a market space that sees a tremendous amount of activity with consumers regularly buying products that make their life better. At the same time, companies keep the ever-changing needs of today’s customer in mind and launch new products to satisfy those needs.

This frequent introduction of new products by different brands has substantially augmented the scale and the product price range in this market space. With the high costs of consumer durables involved, one has to plan well before buying. This is where consumer durable loans comes into the picture. These loans provided to customers by banking and non-banking financial institutions to purchase consumer durables. The loan amount can be repaid in EMIs as per the tenor of the loan. Simply put, consumer durable loans help bridge the gap between the product price and a customer’s affordability and makes buying consumer durables easier.

The Convenient Consumer Loan (CCL) by Muthoot Finance is the latest entrant in the consumer durables finance option space. Having built its repertoire in gold financing, the Convenient Consumer Loan is an ideal consumer-centric finance option by the company where consumers can make their untapped assets (gold ornaments) work for them to finance their consumer durable needs.

The Convenient Consumer Loan can be used to finance a large number of durables ranging from TVs, refrigerators, ACs, washing machines, microwaves, juicer-mixers, vacuum cleaners to home electronic products like mobiles and tablets, digital cameras, laptops and PCs, home audio systems, digital cameras and gaming consoles. And that’s not all, these loans also cover high value durables like furniture, 2-wheel and 4-wheel automobiles and home décor products as well. In fact, such is the flexibility of this loan, avenues like travel finance and personal loan are also covered under the loan.

Features of the Convenient Consumer Loan

- Loan Amount – Minimum loan amount is Rs. 10,000 and the maximum loan amount is Rs. 1,00,000. However, this 1 Lakh is the limit per loan and not the maximum a customer can get.

- Loan Tenor – 12-36 months

- Interest rate – 11% flat.

- 100% finance

- Loan can be closed at any time after paying all the EMIs without any pre-closure penalty. In addition, rebate is allowed on early closure.

- 24% interest charged on EMI for the period of delay in case there is a late payment on an EMI.

What gives the Convenient Consumer Loan the edge over other finance options?

The Convenient Consumer Loan has been designed keeping in mind the aspirations and expectations of the modern consumer in mind and has striking features that make it a preferred option for financing consumer durables.

High Tenor with Low Interest Rate – Loan repayment tenor of up to 36 months along with a flat interest rate of 11% makes it a very prudent finance option.

100% finance – While the currently available finance options provide up to 100% finance, the Convenient Consumer Loan provides definite 100% finance without any conditions.

No initial payment – Since the loan is backed by gold, consumers do not need to pay any down payment on a purchase. The loan amount can be fully repaid in the form of EMIs.

A very diverse loan option – The Convenient Consumer Loan cover avenues ranging from consumer durables and furniture and décor to financing 2-wheel and 4-wheel automobiles, personal loan and travel finance. It’s this diversity that makes it a truly convenient loan.

Easy Prepayment – The loan amount can be prepaid without any penalties and consumers also get rebate while prepaying the loan.

These features collectively add to the transparency and convenience that the Convenient Consumer Loan has to offer. Couple that with quick loan disbursal, in-house evaluation and minimum documentation, and you have an efficient and frugal finance option at hand when you think of buying a consumer durable the next time.

For more information, click here – http://bit.ly/CCLinfo