convenience

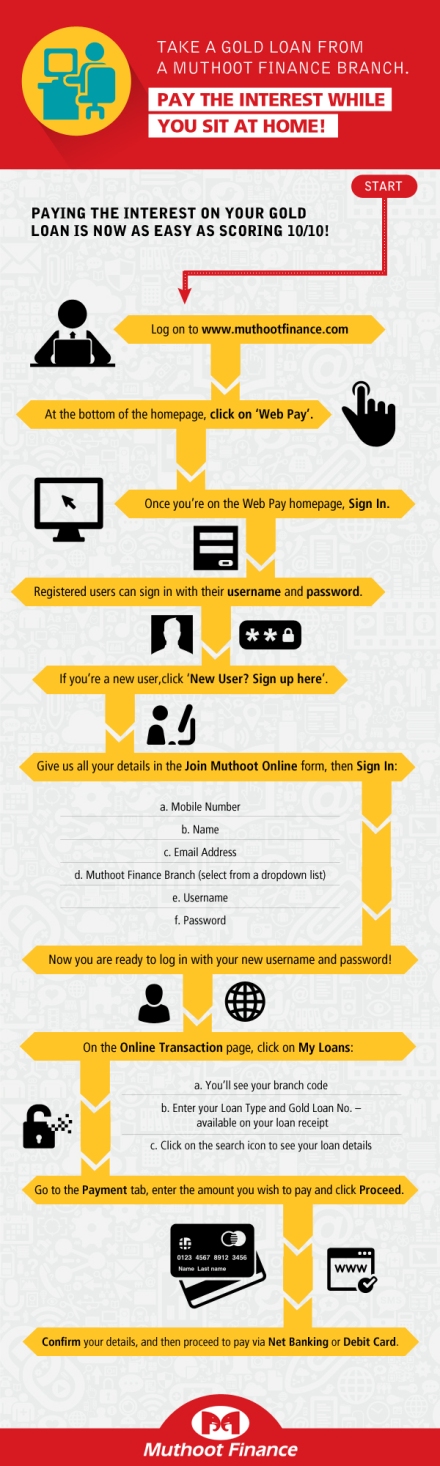

Pay your interest within few clicks!

What are the Benefits of Gold Loan?

Availing of loan against gold is a good idea to help you fill the gap when you are in need of cash. Loans against gold are attractive avenues for people as they have the comfort of paying the amount in time or before time.

The best way to choose the best loan for you is by comparing the gold loan interest rates. Muthoot’s interest rates are competitive and their tailor made features help you get the most out of your gold.

Here are the benefits of a Gold Loan:

No income needed:

Banks take into consideration your credit history and your pay back capacity while considering you for a loan. Banks prefer those individuals who have a good pay structure as it is easier for them to pay the loan back.

However, minimal documentation is required to get the gold loan sanctioned from Muthoot Finance. Also, Muthoot will provide you with a loan of certain pre-decided percentage of the gold pledged. The loan is sanctioned on the basis of the quality of the gold pledged. Thus, even an unemployed person can avail of this loan.

Weak Credit Record

Even if you havea weak credit history, the loan lending institutions arenot affected by it. Since, it is a secured loan and you are pledging gold as collateral, the lending institution does not need to assess your credit history. Even though you have a weak credit history, you can avail of a loan against gold when in need of money.

Low interest rate

Another benefit of a loan against gold is the low interest rate. It is lower than the interest charged by banks for personal or home loans. The interest rates vary between 12%-16% annually. This is particularly beneficial for those who are looking to borrow money at an affordable rate.

One-time payment

You have the choice to make a onetime payment. This means that you can choose to pay only the interest during the loan period and the rest of the amount in a single payment at end of the loan duration.

Convenient

Our gold loans are convenient and quick as they take just a few minutes (15-20) to be disbursed. The financial institutions sanction not more than 75% of the market price of the gold pledged.

Easy repayment procedure

Unlike personal or consumer loans, you need to repay the gold loan at the end of the loan tenure. You do not have to go through hassle of paying EMIs every month. However, specific interest amount has to be serviced periodically as per the terms of sanction. Repayments can be done by cheque, DD or cash.

Conclusion

Our gold loans are good bet for you, if you are in need of lump money and you don’t have the required documentation to avail of conventional loans. So, the next time you need to give your finances a push, think gold.